Utilising Forex Broker Platforms: How to Trade

Libertex

MetaTrader 4 (MT4) is one of the most popular third-party trading platforms on the internet market, with support offered by over a thousand brokers. Libertex is without a doubt the best paper trading platform for Americans that works with MT4, not least because technology offers tight spreads on all markets.

Once you have registered with Libertex, you can use your login details to access MT4. The cash for your paper trading will then be available to you immediately, totaling €50,000. With this option, you can discover all that MT4 has to offer, such as its advanced club types, technical indicators, and charting tools.

Additionally—and maybe most significantly—you can also use a fully automatic forex EA or forex robot. Simply download and install the relevant software package into MT4 to complete the process. Then, in a completely risk-free mode, you can activate the robot using MT4/Libertex to see how it operates in real-time market conditions.

It should be highlighted that Libertex is a great choice if you intend to trade using leverage. The broker offers up to a 1:600 ratio for professional clients; for ordinary investors, the ratio is lower. Regarding reputation, Liberext, which was introduced more than 20 years ago, is governed by CySEC. You will thus be working with a broker that has a strong reputation and extensive experience in this field.

Libertex fees

Pros:

- Tight spread CFD trading.

- Good educational resources.

- Very competitive commissions.

- Long established broker.

- Merchandise stocks and indices like the Dow Jones.

- Uniform with MT4.

- Great option of markets.

Cons:

- Simply offers CFDs.

CFDs are complicated financial instruments that carry a high risk of losing money quickly because of leverage. 74% of retail investor accounts that trade CFDs with this service experience financial losses. You should think about whether you comprehend how CFDs function and whether you are willing to accept the high risk of losing your money.

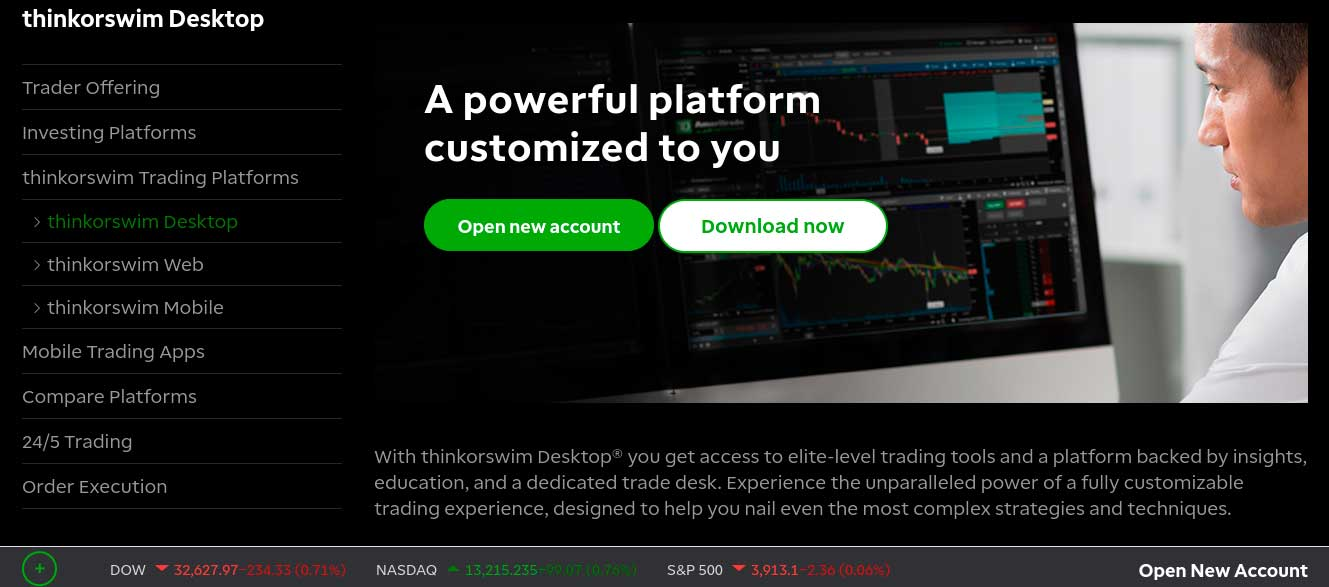

TD Ameritrade

In the realm of internet brokerage, the 1975-founded TD Ameritrade needs no introduction. You have access to every asset type known to man through this premier platform, which now boasts more than 11 million users. TD Ameritrade in particular is responsible for Thinkorswim, one of the most user-friendly trading systems in the market.

This trading platform is loaded with cutting-edge capabilities and may be used online, through desktop software, or through a mobile app. The displays, technical indicators, fundamental news sources, and economic statistics are all completely customisable.

Importantly, there are $100,000 in demo funds pre-loaded on the thinkorswim paper trading interface. This allows you to test out sophisticated tactics and systems using the thinkorswim paper trading capability without putting any of your money at risk.

You won't pay a trading fee when buying and selling U.S.-listed stocks and ETFs in the open market. Other than the fact that it is not ideal for beginners, TD Ameritrade's main flaw may be the somewhat drawn-out nature of the process for establishing business relationships. More information about it can be found in our comparison of TD Ameritrade and Allegiance. As a result, plan on waiting a few days before your professional relationship is completely flexible.

TD Ameritrade fees

Pros:

- App is available on iOS and Android devices.

- Trusted Us brokerage firm.

- Buy stocks and ETFs commission-free.

- Options can be traded at just $0.65 per contract.

- Fully-fledged paper trading account.

- More than than eleven,000 mutuals to cull from.

- No business relationship minimums.

Cons:

- Not equally convenient as other investing apps in the market.

- The sheer size of tradable markets on offer can appear overwhelming.

Webull

With the majority of online brokers now providing an application for both iOS and Android, the mobile trading market is expanding at a rapid rate per unit. Consider Webull if you live in the United States and are looking for the top paper trading app available right now.

If you're searching for an easy way to purchase and sell stocks, this brokerage app is perfect for you. This is so because the programme doesn't charge any commissions for stock trading. Additionally, this applies to cryptocurrencies, ETFs, and options.

You will initially need to establish an account in order to use the Webull paper trading platform. This is typical procedure and calls for some straightforward personal data from you. Once you have everything set up, you must go to your account menu and choose the "Paper Trading" push.

Then your account willfully enters "Demo Mode," which is already filled with a $1 million paper trading balance. You can change to the "Real Way" at any time. Webull does provide zero-committee trading, but it's vital to keep in mind that there is a monthly charge involved.

Even if you only utilise the paper trading service, you still have to pay the monthly fee, which starts at only I for a Standard Business partnership. As a result, you should only use the demo account at Webull if you ever want to use the programme to purchase and sell assets using real money. If you ever want to trade with small amounts of money, Webull has no minimum eolith requirement, which is great.

Webull fees

Pros:

- Includes highly advanced technical charts.

- Commission-gratis trading.

- Global stock, ETF, options, and crypto trading.

- Fully customizable indicators.

- Ready upward unlimited watchlists and circuitous alerts.

- Includes bones social network and analyst recommendations.

- Highly regulated in the United states of america.

Cons:

- No forex or commodity CFD trading.

- Payments are simply by banking concern or wire transfer.

- Merely available to US traders.

- Limited educational resources.

- Less than optimal customer support.

Interactive Brokers

One of the most comprehensive asset libraries available in the online investment market is provided by reputable brokerage company Interactive Brokers. Simply said, you will have access to more than 135 markets from 33 distinct legal systems. Almost every asset grade imaginable is covered by this.

You have access to a full range of long-term investments in item, including stocks, ETFs, common funds, index funds, and 50/50 IPOs. Before we discuss the fundamentals, we should point out that as soon as you register, you'll be qualified for an Interactive Brokers newspaper trading simulator.

All buy/sell positions are pre-loaded with a $1 million paper balance, and the market's current condition is reflected in all of them. If you already have a commercial relationship with Interactive Brokers, you have the option to switch to demo mode at any time. Even if you used the final $1 million of your demo money, you can always reset the technology.

There is no minimum investment requirement once everyone has used Interactive Brokers' newspaper trading platform and wants to start trading with real money. However, you will need to transfer money from your bank account because Interactive Brokers does not take debit/credit cards or east-wallets.

You can buy and sell American stocks now without paying any fees, just like on brokerage sites that are situated in the US. Depending on your account type for the associated transaction or commutation, other markets will have a dealing cost.

We also value the partial trading option that Interactive Brokers offers. In plain English, this means that regardless of share price, you can purchase any stock of your choice for just $1. Interactive Brokers permits fractional ownership in US-listed penny stocks as long as the company in question has a daily trading volume of $10 million or higher.

Interactive Brokers fees

Pros:

- Really advanced trading features and nautical chart assay tools.

- Huge library of traditional stocks, index funds, and ETFs.

- More than 135 markets across 33 countries.

- No minimum eolith.

- Buy U.s.-listed stocks and ETFs commission-free.

Cons:

- Non suitable for newbie investors.

- Fee structure is a flake confusing.

Newspaper Trading Guide

If you are unfamiliar with paper trading platforms in general, the sections below will explain how they operate. After that, you will typically need to open a brokerage account in order to access the specific newspaper trading service.

What is Paper Trading?

Simply explained, paper trading is the practise of buying and selling financial instruments without assuming any risk. You will be working with "demo funds" rather than real money, which is why this is the case. As a result of how closely the best demo accounts replicate actual market conditions, it is implied that you can learn the ins and outs of trading.

As we previously discussed, in order to use a virtual online broker's newspaper trading platform, you must first establish a business partnership with them. Sometimes, all that is required is the provision of some personal information and contact information. Importantly, this implies that you can use the demo function without having to brand an eolith or provide any identification.

Benefits of Paper Trading

All levels of investors can use the historical paper trading software providers. There are numerous advantages to adopting such a platform there.