Best Review Of TopFX Forex Brokers 2023, More Top Detailed

TopFX is a multiasset brokerage firm operating on a global scale with an emphasis on liquidity supply. The broker has provided brokers and other financial institutions with liquidity solutions since 2010. They provide leveraged trading of more than 1000 assets, including Forex, Shares, Indices, Metals, Energies, ETFs, and other CFDs, with the tightest spreads on the market and razor-sharp accuracy.

Over 180 Forex brokers, investment companies, and hedge funds have benefited from TopFX's exceptional liquidity solutions over its ten years of operation in the CFDs market.

TopFX increased the breadth of its starter packages during the past few years, lowering the high entry barrier to the fiercely competitive forex market.

TopFX is a STP Forex Broker with strict standards for a secure trading environment as a result of the restrictions it imposes. Among the active nations in Europe, Asia, and Africa where the broker has clients are Indonesia, Thailand, Malaysia, Vietnam, and Nigeria. The customer offering is large and even comprehensive because it provides the same or even more investment possibilities to the global trading community.

Access to a moderate selection of CFD markets and currency pairs is provided by TopFX, which also provides the MetaTrader and cTrader platform suites. In contrast, TopFX finds it difficult to compete with the top brokers in a number of areas, including market analysis and education.

TopFX has expanded its business to provide brokerage services to traders directly in addition to providing liquidity to retail brokers. Customers now have access to a wide range of assets, a modernised MT4 trading platform, and cTrader as a stand-in since 2010. Indicating access to significant liquidity, the price environment for commission-free and commission-based accounts remains among the best in the entire sector. TopFX is still a leading choice for automated trading solutions and copy trading using the cTrader platform's built-in feature.

TopFX Pros and Cons

Pros

- Powerful cTrader platform capabilities

- Global expansion to include Australia, Asia, the Middle East and North Africa, and Europe

- cTrader platform integration for autochartist.

- Founded in Cyprus known for its great technology

- Low Spreads

- MetaTrader 4 and cTrader are both available.

Cons

- International proposal performed through offshore branch

- No 24/7 support

- No comprehensive education

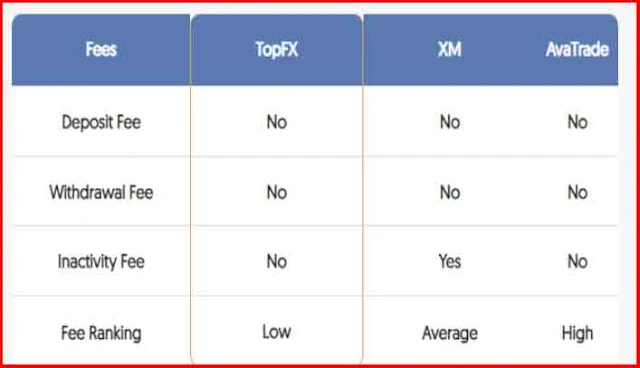

TopFX Fees

Clients benefit greatly from TopFX's excellent pricing advantage as a liquidity provider. One of the best among brokers, the commission-free structure starts at a minimal mark-up of 0.5 pip, or $5 each 1.0 standard lot. One of the most trader-friendly options is available to traders who choose the commission-based option: raw spreads starting at 0.0 pips for a commission of $2.75 per lot or $5.50 each round lot. Swap rates on leveraged overnight positions and potential third-party deposit and withdrawal fees are additional expenses. After 90 days of dormancy, TopFX levies a $5 monthly inactivity fee and transfers corporate action on to client portfolios. Overall, the pricing environment at TopFX is among the most aggressive.

By following these procedures, MT4 traders can quickly access swap rates from their platform:

1. In the Market Watch box, right-click the target symbol and choose Symbols.

2. After choosing the preferred currency, select Properties on the right side.

3. Scroll down until you see Swap Long and Swap Short.

Moving on to the crucial aspects about trading costs, we strongly advise you to double-check the terms because they may fluctuate significantly depending on the trading platform you choose and the account type you choose. TopFX costs vary depending on the type of account you use, so be careful to pick one that satisfies your needs.

While there is no cost for Zero account types, the broker charges 2.75 EUR per side and per lot for Raw Accounts.

TopFX Based on our analysis and comparison with more than 500 brokers, fees receive a 7.8 out of 10 rating. Additionally, for some account types, the broker levies a commission fee each lot. The prices vary based on the business.

TopFX Account types

The choice of account type at TopFX is based on your preference because both accounts have ultra-low spreads and sharp execution available to you.

If you utilise a RAW account, you can trade with spreads starting at 0.0 pips and commissions of €2.75 per lot per side. The TopFX RAW account is ideal for traders who prefer to receive a raw price feed and pay commissions separately. TopFX RAW accounts are equally cost-effective as their ZERO accounts, even though for some traders it might be a factor enhancing order execution transparency.

They provide liquidity and have unbeatable prices that are difficult to get elsewhere. TopFX offers the exact same rate for both types, in contrast to the common industry practise of charging basic, no-commission accounts more than raw spread accounts.

You can trade with among of the lowest market-wide all-inclusive spreads when you choose the TopFX ZERO account. Additionally, the broker's lightning-quick execution and abundant liquidity guarantee a very productive trading environment.

TopFX Deposit and Withdrawal Methods

TopFX provides a variety of deposit options, Negative Balance Protection, and no deposit fees. Each and every client's money is kept in separate accounts with recognised banks.

TopFX doesn't impose any fees on deposits or withdrawals, but your bank or payment processor might. In separate accounts with reputable banks, TopFX keeps your money apart from its own funds. For this reason, TopFX will never utilise your money for operations or other purposes.

The rating for TopFX Funding Methods is 8.2 out of 10. The minimum deposit is one of the lowest, and there are no deposit or withdrawal fees levied by the broker. The selection of funding ways is also extremely broad, which is a plus.

On both cTrader and MetaTrader, users can access the two account types that TopFX provides. There is the spread-only ZERO account as well as the commission-based RAW account. The commission for the RAW account is 2.75 EUR per side (5.50 EUR for a round turn standard lot). Depending on the payment method you choose, there are various minimum deposits. Keep in mind that average spreads cannot be used to calculate the true cost of trading with TopFX.

Deposit procedures

The following payment options are accepted by the broker:

the use of bank wires

TopFX minimum deposit Credit/Debit Cards (Visa, MasterCard) Online payment processors PayPal, Neteller, and Skrill

Since TopFX has no minimum deposit requirement, you can open any of the two account types the broker offers with the funds you have available.

Compared to other brokers, TopFX's minimum deposit

Source:

- https //www dailyforex com/

- https //55brokers com/