BDSwiss Broker More Best Review Need to Read

A global brokerage firm called BDSwiss was established in 2012. Since its founding, it has rapidly gotten in close proximity to the markets, expanded to become one of the largest trading organisations, and is currently one of the leading players. With more than 1.5 million traders and more than 1.5 million customers who have enrolled from more than 186 countries, BDSwiss presently caters to an exclusive Member club.

As a result of the company's Swiss origins, it has a strong base in the neighbourhood and provides internet trading services as a member of a global operating group with offices established in cities including Kuala Lumpur, Malaysia, Tirana, Albania, and Pristina, Kosovo. For further details, see our BDSwiss Review and summary section.

In addition to providing its own exclusive BDSwiss Mobile and WebTrader apps, the BDSwiss brand serves over 1.6 million registered forex and CFD traders. Although its spreads are greater than those of the leading companies in the sector, BDSwiss has access to over 1,000 tradable symbols, generates high-quality research, and exhibits strong order execution statistics (which the broker discloses monthly).

BDSwiss launched in 2012 and has since dominated the online trade market with a carefully selected selection of goods and services created with a variety of customers in mind. 1.5 million or more registered accounts, $84 billion or more in average monthly trading volume, and clients from 186 nations. BDSwiss goes above and beyond by offering a wealth of educational resources, current market information, and first-rate customer service.

BDSwiss offers support, training materials, and often posted analysis in addition to the sophisticated tools that institutional clients and expert traders prefer. Additionally, the combination of services and goods like Autochartist and expert funds

BDSwiss Pros & Cons

Pros

- Outstanding liquidity and speedy execution.

- Excellent educational resources and regular market webinars.

- Wide Forex and CFD instruments.

- MT4, MT5, Mobile App, and Proprietary Platform are the options.

- Quality customer support.

- Internal staff members produce the market coverage series for Daily Videos.

- carries out the role of an agency broker, displaying balanced slippage with no requotes or order rejections (execution statistics are published monthly).

- Through the BDSwiss Telegram channel, traders can receive real-time notifications and trading signals.

- Highly accessible and user-friendly customer support channels.

- VIP customers have access to 500 trend patterns in the Premium version of Trend Analysis.

Cons

- Support not available 24/7.

- The platform does not presently accept any US citizens.

- Following regulatory investigation into the broker's marketing tactics, the FCA ordered the broker to stop providing CFDs to clients in the United Kingdom.

- Beginner’s educational content lacks a progress-tracking feature.

- Spread of 1.6 pips on the EUR/USD for its Classic account is expensive, despite the good execution statistics.

- Operating via International Entities.

DSwiss has a good reputation, a long operating history, which is advantageous, and convenient trading conditions. Additionally, a wide variety of trading platforms are available, opening an account takes little time, and customer service is of the greatest grade.

The BDSwiss trading proposal, on the other hand, is dependent on the entity and the instruments are restricted to Forex and CFDs; therefore, it may be worth giving it another look if the proposal is right for you. For the time being, the Broker exclusively uses its international entities.

What is the minimum deposit for BDSwiss?

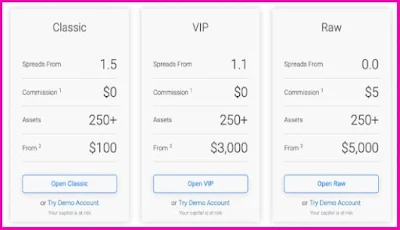

A different minimum deposit can be required at BDSwiss depending on the account type you choose. The minimum initial deposits for the broker's VIP and Raw accounts are $3,000 and $5,000, respectively, depending on where you live and whether you were referred by someone else. The minimum initial deposits for the Classic account are $100 (or the equivalent in another currency).

BDSwiss Account types

Three account types—Classic, Vip, and Raw—are provided by BDSwiss. They were designed to meet the needs of various Forex traders by providing reduced prices for smaller trade amounts and more advanced facilities for larger trade quantities. According to the account comparison picture below, while Classic and Vip accounts are based on the spread-only model, Raw accounts also have interbank spreads and commission fees each lot.

How to open Trading Account?

- Access the BDSwiss Sign In page.

- Enter your personal information (Name, email, phone number, etc).

- To authenticate your identity, upload your papers. It is legal to examine documentation of your residency, such as a utility bill, your ID, or something similar.

- Ask in-depth questions about your trading history and goals.

- Once your account is activated you will get access to your account area.

- Next, you can move forward with fundraising after learning about all the dangers and advantages associated.

- Almost instantly you will be able to start trading through BDSwiss platforms.

For whom is BDSwiss advised?

Due to the platform's wide range of offerings and focus on providing exceptional execution and competitive pricing, investors of all types will be able to discover value in BDSwiss' services. Straight-through transaction processing, continually updated market news, and well-known tools like MetaTrader 4 and MetaTrader 5 are all advantages experienced traders may take use of.

Demo accounts, minimal starting deposit requirements, numerous instructional programmes offered through the Trading Academy, and even daily webinars meant to keep traders updated on changes in market conditions make the platform welcoming to new users looking to gain more experience.

Source :

- https //55brokers com/

- https //www investing com/

- https //www forexbrokers.com/